— built for Indian businesses selling across borders.

International Payment Gateway @2.75%*

No limit on transaction volume *T&C apply

Apple Pay’s built-in authentication signals help you achieve 95+% authorization rates and reduce drop-offs by offering a payment method issuers trust.

All Apple Pay transactions are tokenized and actual card details are never shared. With Face ID or Touch ID and PayGlocal’s fraud controls, ensure end to end security.

Accept payments from over 500 million Apple Pay users across 80+ countries like US, UK, UAE, Singapore, Australia, Canada, and more, giving customers a familiar and trusted way to pay.

PayGlocal handles the full Apple Pay flow from compliance and authentication to settlement, so merchants can go live globally with minimal effort.

Getting paid from international customers shouldn’t be so difficult. But between currency conversions, delayed settlements, and surprise deductions — it’s a mess. With PayGlocal, it’s not.

We’re cross-border first. And, we’ve built a smarter way for Indian businesses to collect global payments. One that just works.

Accept international cards, wallets, and local methods with up to 90% success on global transactions.

Go live fast with APIs, plugins, or no-code tools. Launch in days, not weeks.

Get your money quickly, directly in your Indian bank account. No delays, no follow-ups. With full visibility

Stay audit-ready with KYC, AML, FIRC, and RBI-compliant processes — already handled.

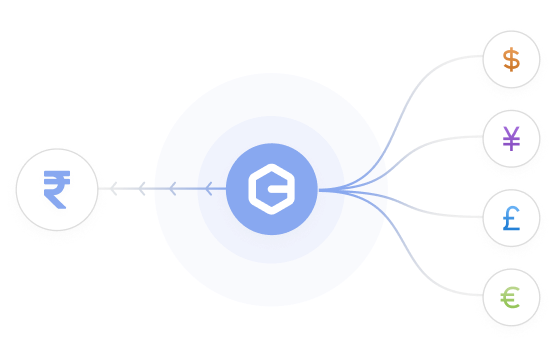

Let customers pay in their local currency. You get INR — auto-converted and settled.

And that's okay.

Real-time detection to block fraud before it happens — and reduced chance of chargebacks.

We help shield your business from the financial hit of fraud-related disputes.

Suspicious transactions are filtered automatically — genuine customers go through, friction-free.

CTS and FTS fraud reporting, handled behind the scenes — with full visibility and zero manual effort.

Our intelligent checkout reduces failed payments that often turn into chargebacks.